📖 Estimated reading time: 2 min

It is independent and its main objective is to control inflation, maintain the stability of the purchasing power of the currency and guarantee the full functioning of the financial system.

To achieve these objectives, the Central Bank uses various tools, such as monetary policy and regulation of the financial system.

Monetary policy is the set of measures adopted by the Central Bank to control the money supply and, consequently, the interest rate.

The regulation of the financial system aims to guarantee the security and transparency of the financial market. In addition, the Central Bank is also responsible for ensuring exchange rate stability, i.e. controlling the exchange rate between the real and other currencies. This is done through exchange operations, which aim to increase or decrease the supply of dollars on the market.

Another important function of the Central Bank is to supervise and regulate financial institutions, such as banks, finance companies and brokers, in order to guarantee the security of deposits and the transparency of operations.

The issuance of money is directly related to inflation. When there is an increase in the amount of money in circulation, without an equivalent increase in the production of goods and services, prices tend to rise. This is because there is more money competing for the same amount of goods, which leads to the law of supply and demand.

There are a few factors that can influence the relationship between money issuance and inflation:

* Speed of money circulation: If money circulates quickly in the economy, the impact of money issuance on inflation will be greater.

Inflationary expectations:** If people believe that inflation is going to increase, they may start buying more goods and services now, which could accelerate inflation.

* Production level: If the production of goods and services is growing, the impact of money issuance on inflation will be less.

In general, the issuance of money is one of the main factors contributing to inflation. However, it is important to consider other factors that can also influence inflation.

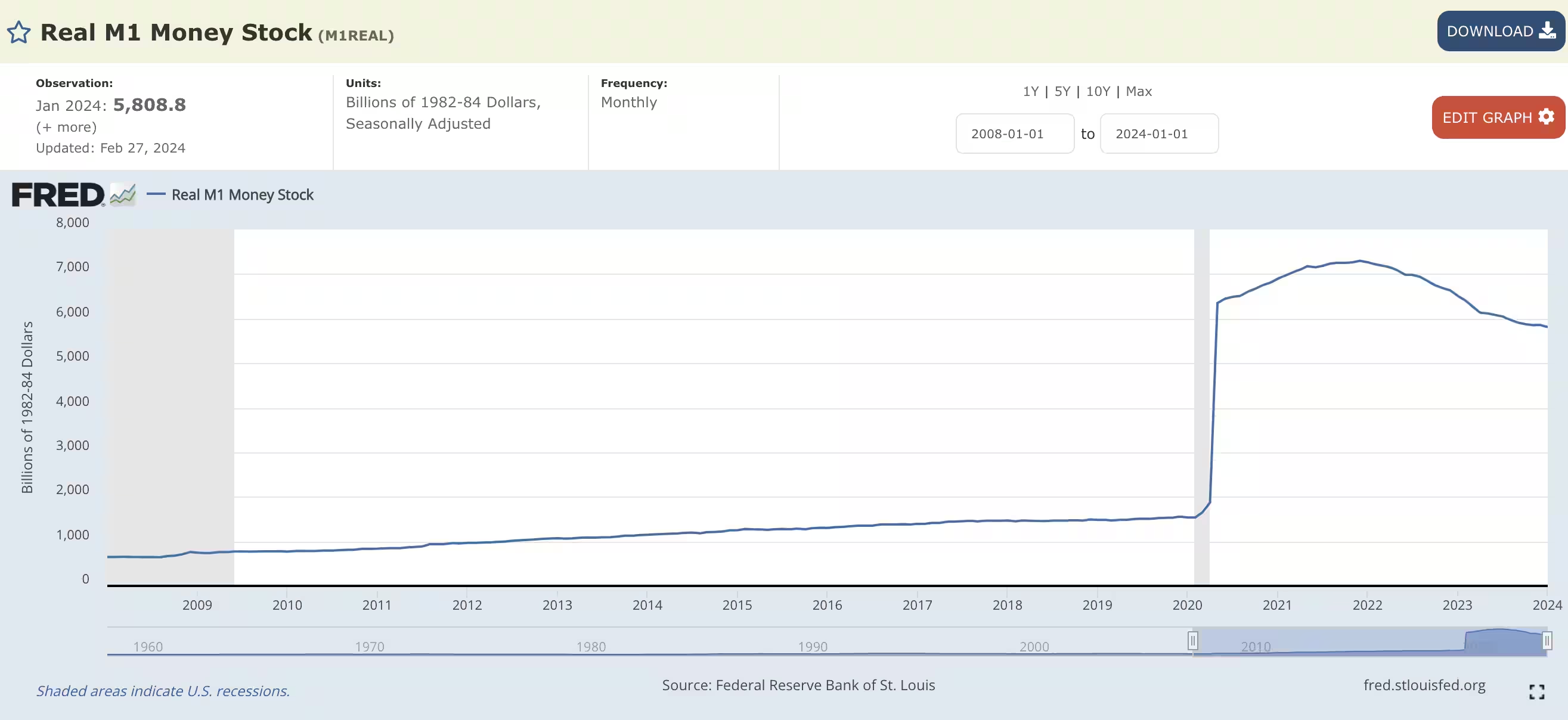

🔴 During the Covid-19 pandemic, a large amount of money was issued, which increased inflation.

The Central Bank is responsible for controlling inflation through monetary policy. One of the tools the Central Bank uses to control inflation is the interest rate.

When inflation is high, the Central Bank can increase the interest rate to discourage consumption and investment. This causes money to circulate more slowly in the economy, which can help to reduce inflation.

On the other hand, when inflation is low, the Central Bank can reduce the interest rate to stimulate consumption and investment. This causes money to circulate more quickly in the economy, which can help increase inflation.

The Central Bank needs to find a balance between interest rates and inflation to maintain economic stability.

The Central Bank of Brazil is a fundamental institution for the country’s economic stability, acting to control inflation, maintain the stability of the currency’s purchasing power, guarantee the full functioning of the financial system and supervise financial institutions.

Did you like the content? Check out these other interesting articles! 🔥

Do you like what you find here? With every click on a banner, you help keep this site alive and free. Your support makes all the difference so that we can continue to bring you the content you love. Thank you very much! 😊